AUSTRALIA, 12 November 2019: First Nations Foundation (FNF) today launches the world’s first digital financial literacy education program to help First Nations people develop their financial knowledge.

While the content of My Money Dream has been developed by Indigenous people for Indigenous people, FNF has added the might and scale of Australia’s largest industries by offering this to the financial services industry, government and employers to engage with their Indigenous customers and staff. The training is a validated training program, adapted from 10 years of face-to-face delivery by the foundation and transforms the lives of individuals, their family, friends and communities.

“We released research in 2019 showing the alarming statistic that 9 in 10 Indigenous people have no financial security. This cannot be transcended without financial literacy, and we are enlisting the help of government and industry to help reach and build a financially-savvy Indigenous population.” First Nations Foundation CEO, Amanda Young, said.

“This is the first step in our Indigenous financial wellbeing strategy. My Money Dream is a brilliant and low-cost way to bring financial knowledge into the lives of Indigenous people at scale. Potentially we can teach tens of thousands of people, because everyone has a digital device.

“We are asking financial services who want to connect with their Indigenous members to buy My Money Dream and offer it, as a powerful way to build skills and trust. We ask governments to help prepare our Indigenous workers of the future with money skills, for people on cashless welfare cards to skill up and exit that system and for employers to attract and retain their Indigenous staff with this professional development tool. We have done the hard work: expert content. All they need to do is buy licenses and start offering to their desired audience.”

Developed with the support of Indigenous Business Australia and Australian Unity Foundation, the program helps First Nations people aged 16 – 60 navigate the financial obstacles unique to Indigenous people, including lessons on money and culture, budgeting, banking, superannuation, insurance,

loans and credit, buying a home, buying a car and financial first aid. Using a clever blend of culture, humour and deep knowledge, it is an engaging learning platform.

“Financial knowledge is a powerful tool for prosperity across communities,” Australian Unity Head of Partnerships Benson Saulo said. “Our ongoing commitment across the Indigenous community is enabling economic empowerment – financial literacy and wellbeing is a critical element of that.”

The platform gives philanthropists who want to create social change in Indigenous communities the power to do so, by allowing them to fund the purchase of user licenses to be distributed on their behalf.

The first philanthropic organisation to purchase licences is the Rowe Family Foundation, managed by Perpetual as trustee. Perpetual’s General Manager of Community & Social Investment, Caitriona Fay, commented on the support of the Rowe Family Foundation:

“As trustee of the Rowe Family Foundation, Perpetual is proud to support Indigenous businesses and communities. Philanthropy has a responsibility to back Indigenous-led organisations who are looking to tackle issues like financial literacy and who are seeking to improve the overall wellbeing of our nation’s Aboriginal and Torres Strait Islander communities.”

The Wunan Foundation will be the first recipient of donated licenses. “Financial literacy education is a vital educational tool in building necessary life skills that equips people both young and old with the financial knowledge, resilience and awareness to manage effectively in mainstream society today” explains Tanya Hill, Manager Financial Wellbeing & Housing Services, Wunan Foundation.

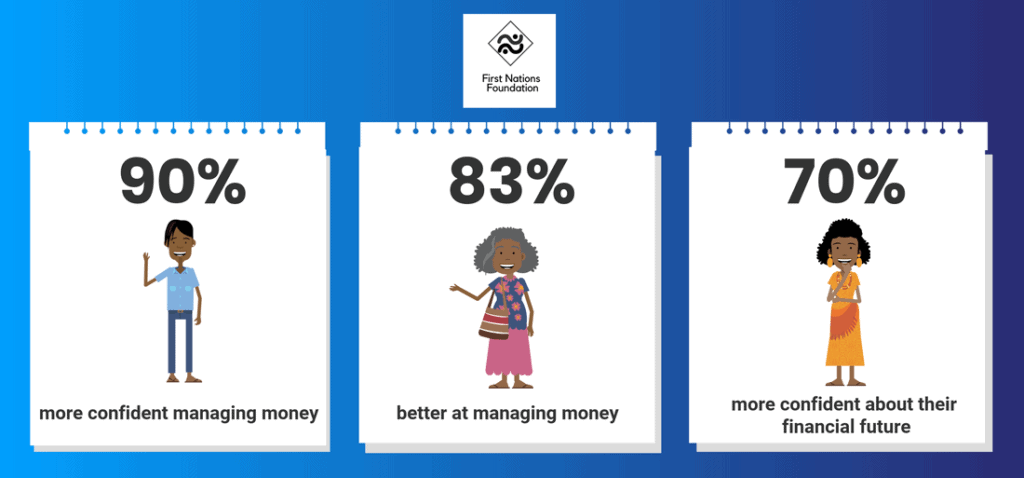

My Money Dream is built on the success of FNF’s in-person financial literacy training, delivered to 1200 people over the last 10 years, where results showed 90% of participants had more confidence in managing money, 83% felt better at managing money, and 70% were more confident about their financial future, confirming recent research that Indigenous-led products work (Oxfam In Good Hands, 2019).

The adaption to an online format was completed by edu-tech leader Androgogic “Androgogic is proud to be a key partner supporting First Nations Foundation and we were delighted to be able to provide both the Educational Technology infrastructure and the courseware development for the My Money Dream project,” said Alexander Roche, CEO/Founder Androgogic & Principal Educational Technologist.

“We are at a time where First Nations people have digital access,” FNF Chair and Yorta Yorta man Ian Hamm said. “This Genesis Generation now have the digital tools for Indigenous economic participation. We offer a meaningful way to learn about money which has personal development elements to work within their community expectations, while still achieving personal goals.”

To purchase licenses for My Money Dream please visit mymoneydream.com.au or email sales@fnf.org.au.